The formula for net book value is the cost of the asset minus accumulated depreciation. Then, the company doubles the depreciation rate, keeps this rate the same across all years the asset is depreciated and continues to accumulate depreciation until the salvage value is reached. The percentage can simply be calculated as twice of 100% divided by the number of years of useful life. At H&CO, our experienced team of tax professionals understands the complexities of income tax preparation and is dedicated to guiding you through the process.

Accounting Adjustments and Changes in Estimates

Over the asset’s useful life, depreciation systematically moves the asset’s costs from the balance sheet to expenses on an income statement. The simplified version of these adjustments is that a special deferred tax asset will be put on the balance sheet to serve as a way to adjust for the difference between the income statement and the cash flow statement. That deferred tax asset will be reduced over time until what does the credit balance in the accumulated depreciation account represent the reported income under GAAP and the reported income to the IRS align at the end of the straight line depreciation schedule. Accumulated depreciation appears on the balance sheet as a reduction from the gross amount of fixed assets reported. It is usually reported as a single line item, but a more detailed balance sheet might list several accumulated depreciation accounts, one for each fixed asset type.

Units of Production Method

The accumulated depreciation account is a contra asset account on a company’s balance sheet. Accumulated depreciation specifies the total amount of an asset’s wear to date in the asset’s useful life. The accumulated depreciation account is an asset account with a credit balance (also known as a contra asset account). If this derecognition were not completed, a company would gradually build up a large amount of gross fixed asset cost and accumulated depreciation on its balance sheet. On the other hand, depreciation expenses represent the assigned portion of a company’s fixed assets cost for a specific period.

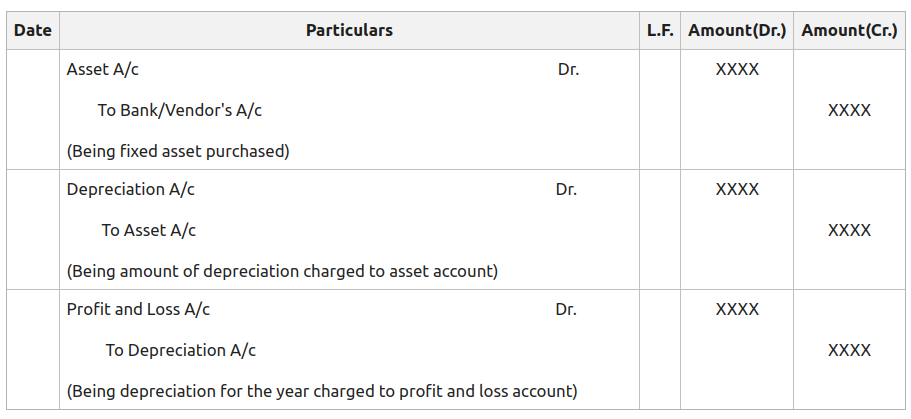

- The journal entry for this transaction is a debit to Depreciation Expense for USD 1,000 and a credit to Accumulated Depreciation for USD 1,000.

- That deferred tax asset will be reduced over time until the reported income under GAAP and the reported income to the IRS align at the end of the straight line depreciation schedule.

- Accumulated depreciation has a credit balance, because it aggregates the amount of depreciation expense charged against a fixed asset.

- To put it another way, accumulated depreciation is the total amount of an asset’s cost that has been allocated as depreciation expense since the asset was put into use.

How Ron Passed His CPA Exams by Going All In

The figure for accumulated depreciation can be located on a company’s balance sheet below the line for related capitalized assets. Let’s say as an example that Exxon Mobil Corporation (XOM) has a piece of oil drilling equipment that was purchased for $1 million. Over the past three years, depreciation expense was recorded at a value of $200,000 each year. Depreciation expense is recorded on the income statement as an expense, representing how much of an asset’s value has been used up for that year. For example, if a company purchased a piece of printing equipment for $100,000 and the accumulated depreciation is $35,000, then the net book value of the printing equipment is $65,000. Accumulated depreciation is used to calculate an asset’s net book value, which is the value of an asset carried on the balance sheet.

Is Accumulated Depreciation a Current Liability?

Here, we will outline the distinctions between depreciation expense and accumulated depreciation in various aspects that pertain to them. After five years, the expense of the vehicle has been fully accounted for and the vehicle is worth $0 on the books. Depreciation helps companies avoid taking a huge expense deduction on the income statement in the year the asset is purchased.

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. For an asset that’s being depreciated over five years, the sum-of-the-years’ digits would be 15 (1+2+3+4+5). For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

These expenses are recognized on the income statement as non-cash expenses that reduce the company’s net income or profit. From an accounting standpoint, the depreciation expense is debited, while the accumulated depreciation is credited. When depreciation expenses appear on an income statement, rather than reducing cash on the balance sheet, they are added to the accumulated depreciation account. Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset. At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero. The depreciation method chosen should be appropriate to the asset type, its expected business use, its estimated useful life, and the asset’s residual value.

This account is paired with the fixed assets line item on the balance sheet, so that the combined total of the two accounts reveals the remaining book value of the fixed assets. Over time, the amount of accumulated depreciation will increase as more depreciation is charged against the fixed assets, resulting in an even lower remaining book value. As mentioned, accumulated depreciation represents the sum of all depreciation expenses for a particular asset as of a certain point in time. It is recorded on a company’s general ledger as a contra account and under the assets section of a company’s balance sheet as a credit. Calculating accumulated depreciation is a simple matter of running the depreciation calculation for a fixed asset from its acquisition date to the current date. We credit the accumulated depreciation account because, as time passes, the company records the depreciation expense that is accumulated in the contra-asset account.

If the vehicle is sold, both the vehicle’s cost and its accumulated depreciation at the date of the sale will be removed from the accounts. Watch this short video to quickly understand the main concepts covered in this guide, including what accumulated depreciation is and how depreciation expenses are calculated. Accumulated depreciation is an account containing the total amount of depreciation expense that has been recorded so far for the asset.

Recent Comments