They also get dividends when issued by the company but do not have a preference to get it. Let us take an arbitrary example of company A to find out how to calculate the number of outstanding shares of the company. We will also try to understand what authorized shares, issued shares, and treasury stocks mean. For example, suppose the number of authorized shares for a company is 5000 shares. The common stock outstanding of a company is simply all of the shares that investors and company insiders own. This figure is important because it translates a company’s overall performance into per-share metrics, making an analysis much easier regarding a stock’s market price at a given time.

Why Is It Important to Understand Common Stock Valuation?

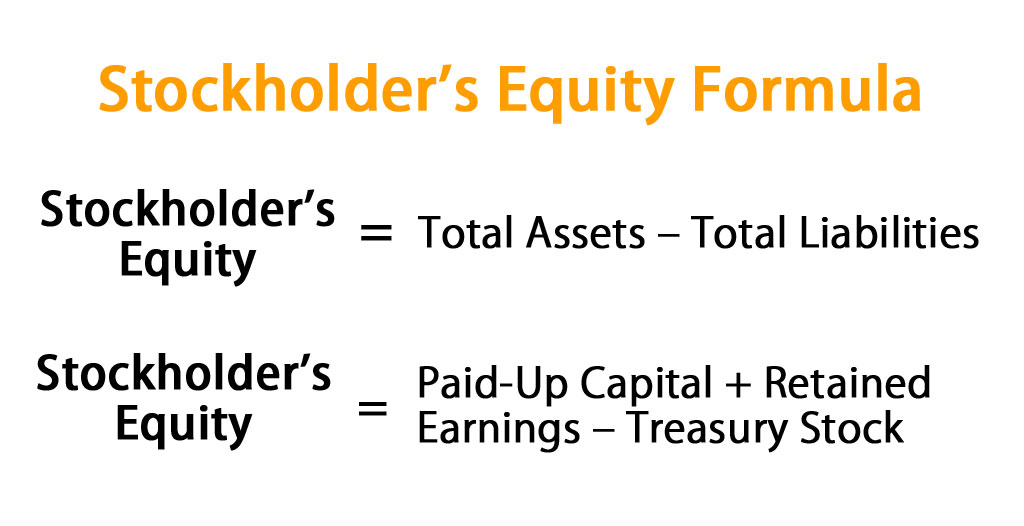

Explore the concept of diversification and its role in minimizing risk. Learn how spreading investments across different assets can protect your portfolio. Thus, from the above details, we can understand the various valuation of common stock. Whether selling an underperforming stock or buying more of a winner, staying engaged with your investments is crucial to enjoying long-term success. Based on this concept, the return of common stock equal to the Bond Yield plus Risk Premium. We assume that the cost of debt is lower than the cost of equity of the same company because the risk of investment in debt is lower than equity.

Shares

In contrast, small-cap stocks often belong to newer, growth-oriented firms and tend to be more volatile. Larger U.S.-based stocks are traded on a public exchange, 15 tax deductions and benefits for the self such as the New York Stock Exchange (NYSE) or Nasdaq. As of mid-2024, the Nasadaq had some 3,377 listings but the NYSE the largest in the world by market cap.

Is there risk to Common Stock?

The primary distinction between preferred and common stock is that common stock grants stockholders voting rights, while preferred stock does not. As a result, preferred shareholders get dividend payments before regular shareholders since they have a preference over the company’s income. The stock market offers a wide range of companies across various sectors and industries. If you invest in a diverse set of common stocks, you can spread your risk and reduce the impact of a poor-performing stock on your overall portfolio. Diversification is a fundamental principle of sound investing, and common stocks provide an effective way to achieve it. The company can raise new funds by issuing new common stock to the market or reinvesting the return from the prior year (retained earnings).

The company reports in its quarterly filling the information for its common stocks. The certificate would indicate the type of stock (common, preferred), any restrictions pertaining to the sale of the stock, the number of shares, the par value, etc. Today, the larger corporations with many shareholders are likely to use electronic records instead of issuing the paper stock certificates.

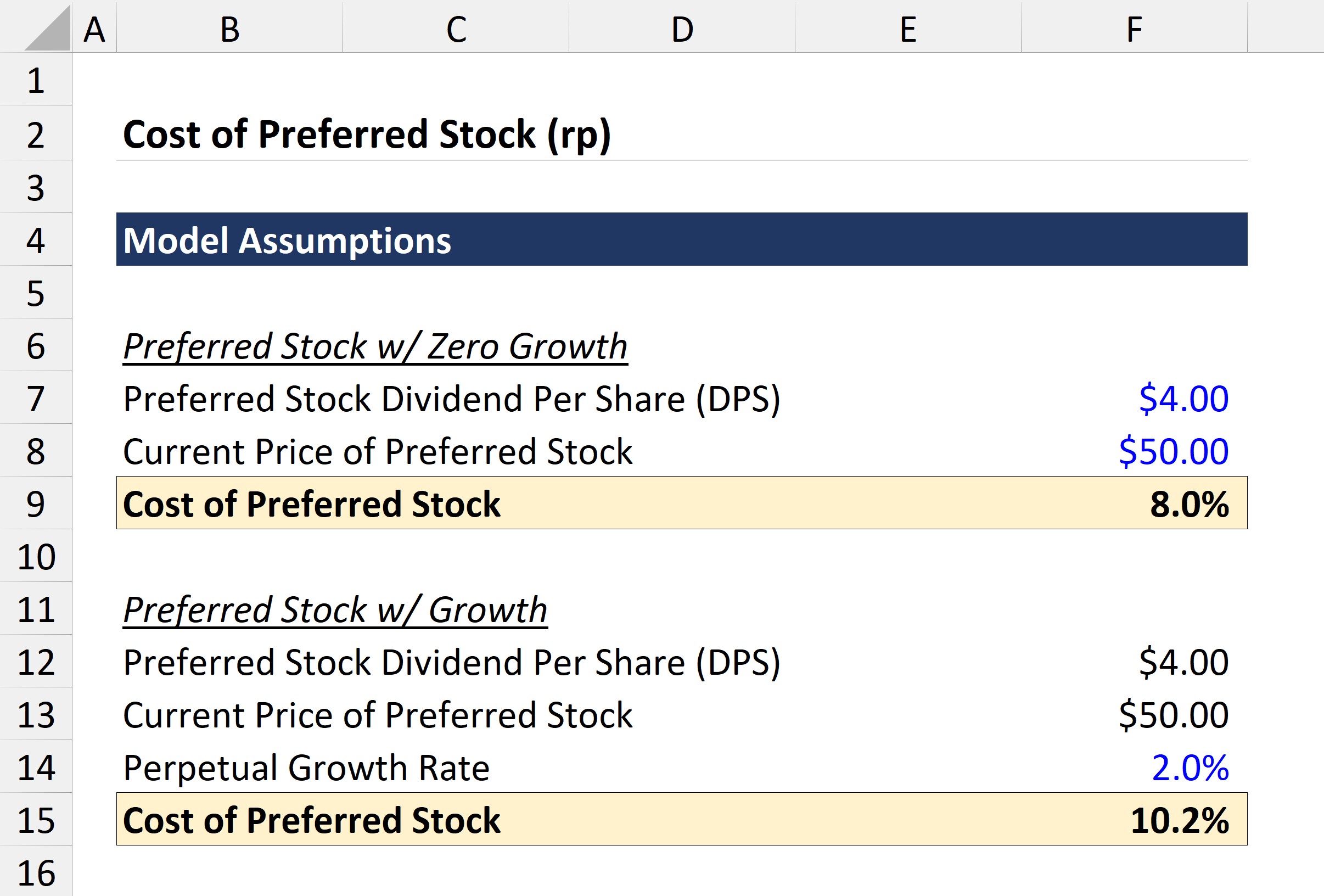

How to Calculate Shareholders Equity

- To figure out how much of a company’s value is held in stockholder equity, you can subtract the company’s liabilities from its total assets.

- Smaller companies that can’t meet the listing requirements of these major exchanges are considered unlisted and their stocks are traded over the counter.

- Any proceeds that exceed the par value are credited to another stockholders’ equity account.

- The features of common stock also has some disadvantages as give below.

State laws may also require that the par value be reported in a separate account. To illustrate, assume that the organizers of a new corporation need to issue 1,000 shares of common stock to get their corporation up and running. All companies must report their common stock outstanding on their balance sheet. You can do that by navigating to the company’s investor-relations webpage, finding its financial reporting, and opening up its most recent 10-Q or 10-K filing.

Intrinsic value is a philosophical concept in which the worth of an object or endeavor is derived in and of itself, independently of other extraneous factors. Financial analysts build models to estimate what they consider to be the intrinsic value of a company’s stock outside of what its perceived market price might be on any given day. Common stock usually comes with voting rights, while preferred stock doesn’t.

Preferred stock may be less volatile but have a lower potential for returns. This suggests that long-term investors who can handle greater volatility will prefer common stock, while those who want to avoid such fluctuations are more likely to choose preferred stock. For a company to issue stock, it initiates an initial public offering (IPO). An IPO is a major way for a company seeking additional capital to expand the enterprise.

For example, if a company declares a dividend of $10 million and there are 20 million shareholders, investors will receive $0.50 for each common share they own. 1.Common Stocks– An investor can purchase both types of stocks when available as both have their own privileges. When people purchase common stocks, it means they have voting right in the important decisions and other events in the company.

Recent Comments