On the other hand, too much inventory could pose cash flow challenges as excess cash would be tied to inventory. In addition to this, excess inventory could also result in additional costs for the business in terms of insurance, storage, and obscene. It is essential for your business to keep track of inventory as less inventory could mean losing revenue and customers. This method is only applicable in cases where it is possible to physically differentiate the various purchases made by your business. However, the disadvantage of using the LIFO method is that it leads to lower profits for your business when inflation is high. This means the goods purchased first are consumed first in a manufacturing concern and in case of a merchandising firm are sold first.

Why You Can Trust Finance Strategists

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. On the other hand, Operating Expenses (OpEx) pertain to the ongoing costs of running a business, independent of the production volume. Both COGS and Operating Expenses represent costs, but they differ in their nature and impact on the financial statements. By understanding COGS, you can explore strategies, such as reducing costs, streamlining processes, and reducing waste, to improve your bottom line. The final inventory will then be counted at the end of an accounting period.

How to Determine Cost of Goods Sold (COGS) and Reduce Expenses

Under the perpetual inventory system of inventory valuation, only increases and decreases in the quantity of inventory (not the dollar amounts) are recorded in detail. This system of inventory helps to determine the level of inventory at any given point in time. But gross profit alone would not help in comparing the efficiency of your business year on year or quarter to quarter. So, in order to achieve that, you’ll need to calculate gross profit margin. The product cost and cost of sales are a few of the most important metrics on your financial statements. No matter how COGS is recorded, keep regular records of your COGS calculations.

Example 2 – Under Perpetual Inventory System

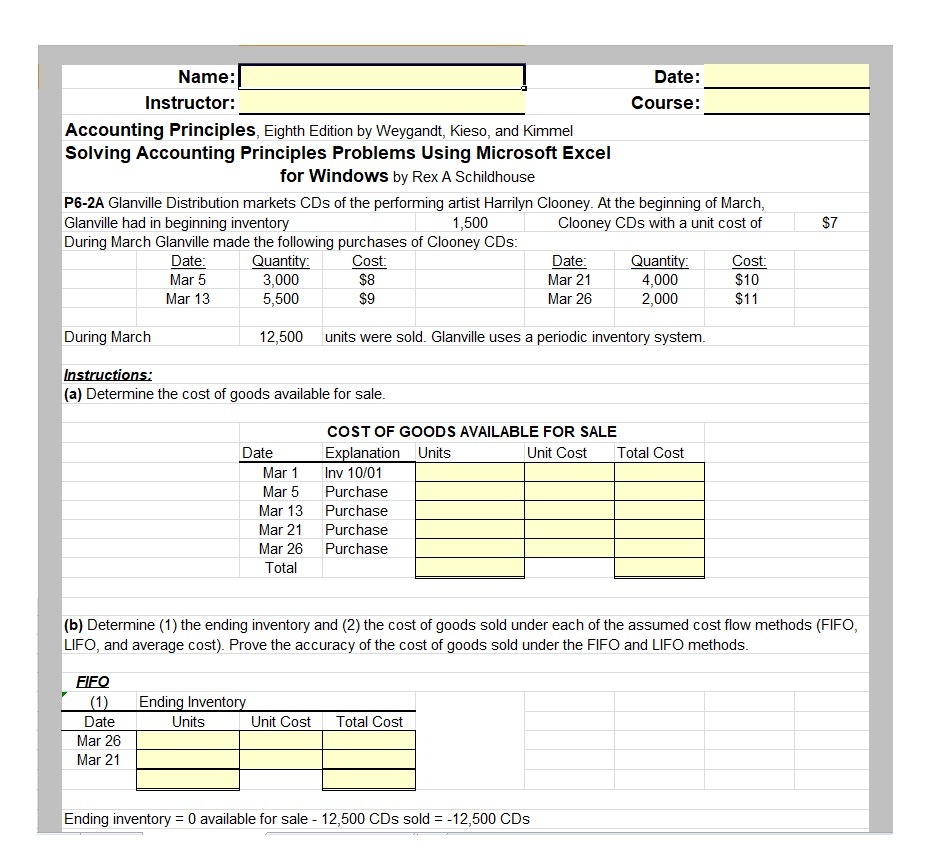

Depending on the business’s size, type of business license, and inventory valuation, the CRA may require a specific inventory costing method. However, once a business chooses a costing method, it should remain consistent with that method year over year. Consistency helps businesses stay compliant with generally accepted accounting principles (GAAP). The LIFO method will have the opposite effect as FIFO during times of inflation.

- Thus, Shane would sell his June inventory before his January inventory.

- This is because items recently purchased at higher price levels increase the cost of goods sold and reduce the net income.

- The things which are manufactured for selling purpose or bought for reselling purpose are known as goods or merchandise.

- Costs of revenue exist for ongoing contract services that can include raw materials, direct labor, shipping costs, and commissions paid to sales employees.

Like most business expenses, records can help you prove your calculations are accurate in case of an audit. Plus, your accountant will appreciate detailed records come tax time. There are best 30 laptop exchange in las vegas, nv with reviews other inventory costing factors that may influence your overall COGS. The CRA refers to these methods as “first in, first out” (FIFO), “last in, first out” (LIFO), and average cost.

The price of items often fluctuates over time, due to market value or availability. Depending on how those prices impact a business, the business may choose an inventory costing method that best fits its needs. The COGS definition state that only inventory sold in the current period should be included. It doesn’t, however, state what order inventory is deemed to be sold. A retailer like Shane can choose to use FIFO (first-in, first-out) or LIFO (last-in, last-out) inventory costing methods. Cost of Goods Sold (COGS) measures the “direct cost” incurred in the production of any goods or services.

The IRS requires businesses that produce, purchase, or sell merchandise for income to calculate the cost of their inventory. Depending on the business’s size, type of business license, and inventory valuation, the IRS may require a specific inventory costing method. The gross profit margin is also calculated by using the cost of goods sold. After the calculation, users will assess whether or not the entity’s gross profits could handle others’ sales and administrative expenses.

By the year-end, it had goods worth $ 10,000 as the closing inventory. Calculate the cost of goods sold by the company for the year ending. Examples of pure service companies include accounting firms, law offices, real estate appraisers, business consultants, and professional dancers, among others.

The final number derived from the calculation is the cost of goods sold for the year. A cost of goods sold statement shows the cost of goods sold over a specific accounting period, typically offering more insights than are found on a normal income statement. So, if we consider companies providing services to their clients, such companies neither have goods to sell nor do they have any inventories. So, in the case of service companies, if COGS is not reflected in the income statement, then there can be no COGS deduction. To apply the specific identification method of inventory valuation, it is necessary that each item sold and each item in closing inventory are easily identifiable. The advantage of using LIFO method of inventory valuation is that it matches the most recent costs with the current revenues.

But understanding COGS can help you better understand your business’s financial health. The average cost method, or weighted-average method, does not take into consideration price inflation or deflation. In these cases, the IRS recommends either FIFO or LIFO costing methods.

When inventory is artificially inflated, COGS will be under-reported which, in turn, will lead to a higher-than-actual gross profit margin, and hence, an inflated net income. LIFO is where the latest goods added to the inventory are sold first. During periods of rising prices, goods with higher costs are sold first, leading to a higher COGS amount. While our 40% margin is standard for our industry, our competitors are outperforming us with 50%+ margins on similar products.

Recent Comments